what is a tax lottery

Afterwards you will be required to pay federal income tax on any portion of your ticket that was not paid for by the buyer. As you can see from the table above your winning lottery ticket bumped you up from the 22 marginal tax rate to the 24 rate assuming you are a single filer and for simplicitys sake here had no deductions.

Lottery Dreams And Tax Realities Lottery Winning Lottery Numbers Lucky Numbers For Lottery

This means your income will be pushed into the highest federal tax rate which is 37.

. Depending on your annual. If you win big in 2018 the federal tax bite is a little less than in previous years because of the Tax Cuts and Jobs Act signed into law by President Donald J. When you win the Lottery you will not get the exact amount you win.

Federal Taxes on Lottery Wins. This is a possible unpopular opinion. Government does not give tax breaks to even the luckiest people in the country.

1304 Million Next Draw. You have to pay some tax on the winning amount. Prize money taxable income.

Lottery is a taxscam. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. Yes all lottery winnings in Illinois are subject to tax.

So many games. And you must report the entire amount you receive each year on your tax return. That means your winnings are taxed the same as your wages or salary.

The Massachusetts tax on lottery winnings is 5 percent the lowest rate of New England states that withhold. 52 rows Where you purchase your winning ticket matters due to state income. On prizes worth 5000 or over 25 Federal Tax is required and all winnings above 1000 are subject to.

I have bought lottery tickets. It means that is you luckily win a lottery in the USA this year. Do seniors pay taxes on lottery winnings in Michigan.

It is taxable to give away Lottery game show or talent show income and TDS is deducted before getting the actual amount. 5499 North Dakota state tax on lottery winnings in USA. Next in line is the federal tax bill.

Or if you dont want to share your fortune these statistically-proven lottery strategies are mathematically guaranteed to win you more money in the fewest number of tickets possible. 4 Oklahoma state tax on lottery winnings in USA. 25 State Tax.

What is Lottery tax. For example if two people win a lottery prize of 10000 and split the proceeds equally 5000 of income is taxable to each person and is. 25 State Tax.

Ive only bought a few lottery tickets since I. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. Tax on the sale of lots or on the receipt of prizes after the drawing of lots.

According to your tax bracket which is decided by how much you earn and other sources of income the IRS withholds 75 of your earnings. Non-Arizona residents typically pay 6 state tax. Winnings are taxed the same as wages or salaries are and the total amount the winner receives must be reported on their tax return each year.

Before I go on I will say this. Lottery winnings are taxed like income and the IRS taxes the top income bracket 396. Because lottery winnings are considered gambling winnings which are definitely considered taxable income the IRS will want its cut.

There is no way you can work around thisthe US. In addition the new 10000 limit on the deduction of state and local taxes restricts the total of your state taxes that can be written. 29 Ohio state tax on lottery winnings in USA.

The Federal tax on lottery winnings 2018 the top tax rate was lowered down from 396 to a total of 37. Federal Taxes on Lottery Winnings. Lottery winningsYou must include winnings from the Massachusetts state lottery and non-Massachusetts lotteries in your Massachusetts gross incomeIf you win more than 600 from the Massachusetts lottery.

I have been to one casino. I have lost money and I have gained a lot more. 25 State Tax.

Texas Lottery - Play the Games of Texas. But that doesnt mean you pay a 24 tax on the entire 145000. The government will withhold 25 of that before the money ever gets to the winner.

The Michigan Lottery does not withhold any taxes on lottery prizes from 601 to 5000 but is required to report the winnings to the IRS and Michigan Department of Treasury. You will pay a lesser amount of taxes. But lottery is a taxscam for the poor and elderly.

Split or assign your lottery winnings in whole or in part the winnings are taxable to each recipient. Winnings of more than 5000 are subject to automatic withholding of 24 federal tax and 425 state tax. Like other income in the United States the IRS taxes lottery winnings.

Texas TX lottery results winning numbers and prize payouts for Pick 3 Daily 4 Cash 5 Lotto Texas Texas Two Step Powerball Mega Millions All or Nothing. Your lottery winnings are taxed just as if they were an ordinary income bonus. Income tax withholding is based on the total amount of the prize won.

A tax of 30 is imposed on non-approved awards and prizes. But if on the off chance you do win millions in a lottery jackpot keep in mind that the Internal Revenue Service will be looking for its fair share. While you dont have to report lottery winnings of 600 or less if you win more than 5000 the government will hit you with a 24 percent federal withholding tax.

North Carilona state tax on lottery winnings in USA. For lottery winnings that means one of two things. Youll either pay taxes on all the winnings in the year you receive the money for winnings paid out as a lump-sum payment.

Taxes on lottery winnings are paid according to the IRS guideline.

Lottery Taxes How Much Tax Is If You Win The Lottery Youtube Winning The Lottery Lottery Tax

Income Tax On Online Earning Income Tax On Online Games Lottery Contest Gambling Betting Game Income Tax Online Earning Online Games

Fancy More Chances For Less Then The Lotto Syndicates Are For You Jump In Now Grab Your Shares And A Major Win Could Be Right Aroun Lotto Lottery Syndicate

The World S Largest Jackpot Closes Soon Usa Power Lotto Is Currently The World S Largest Jackpot At Au 717 Million Hurry Austr Lotto Lottery Lottery Numbers

How Much Tax You Will Pay On Your Lottery Winnings Mega Millions Jackpot Lottery Lottery Tickets

Dave Ramsey Timeline Photos Financial Budget Lottery Financial Tips

Some Of Our Big Lottery Winners Of 2021 Lottery Blog In 2022 Lottery Winner Lottery National Lottery

Pin On The Lottery Office Follow Us

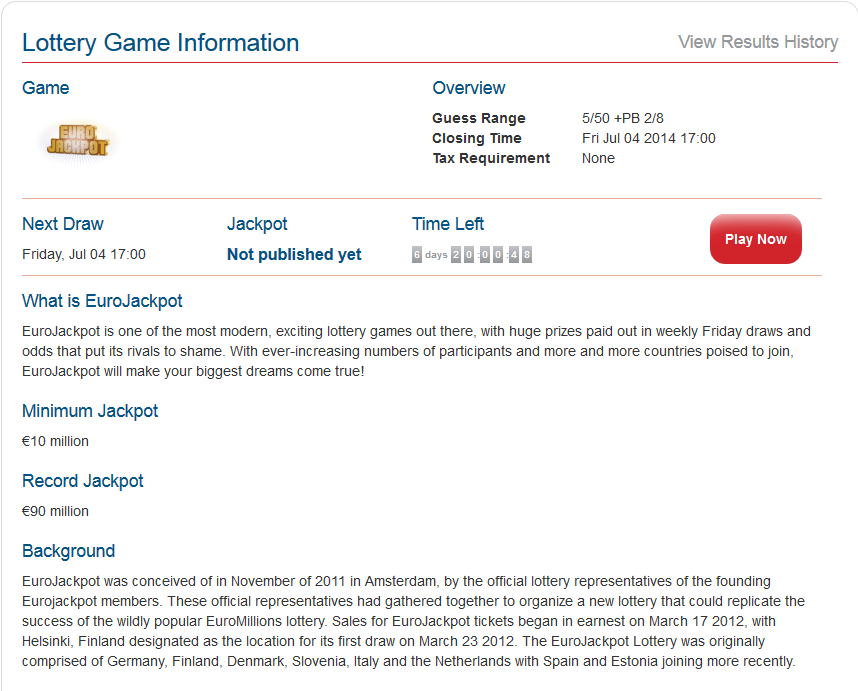

Eurojackpot Reviewv Play Eurojackpot Lottery Online Online Lottery Lottery Lottery Games

Here S The Tax Bill On Powerball Mega Millions Jackpots So Far This Year Lottery Mega Millions Jackpot Jackpot

We Ll Be Back Shortly We Re Going To Be Working On Some Updates Today Therefore Our Website And Apps Will Be Unavailable For In 2022 Lottery How To Apply Jackpot

Pin By Payelroy97 On Newsgater Com State Lottery Lottery Results Lottery

Usa Mega Lotto Real Tickets The Lottery Office Lottery Lotto Tickets Lotto

Online Kbc Lottery Winners Whatsapp No 918986588910 Online Kbc Lottery Manager Help Line Whatsapp Number 91898658891 Lottery Online Lottery Lottery Winner

Lottery A Tax On People Who Are Bad At Math Lottery Math Amazing Quotes

The Lottery Is Really A Tax On The Poor Lottery Good Things Math

Lottery Bonds For Fair Ticket Selling And Timely Tax Payments Lottery Tax Payment Fair Tickets

Here S What You Need To Know About The New Rules For Filing Tax Returns Filing Taxes Income Tax Tax Return